Investing in the stock market can seem daunting for beginners, but understanding key principles can simplify the process. This guide, inspired by the video “How To Pick Stocks For Beginners (Step By Step),” offers a structured approach to selecting stocks wisely.

🎯 Understanding the Challenges of Stock Picking

Many new investors aim to find the “perfect” stock—one that meets all ideal criteria. However, it’s important to recognize that no investment is flawless. The goal should be to identify stocks that align with your investment objectives and risk tolerance.

📈 Evaluating Company Growth: Top Line and Bottom Line

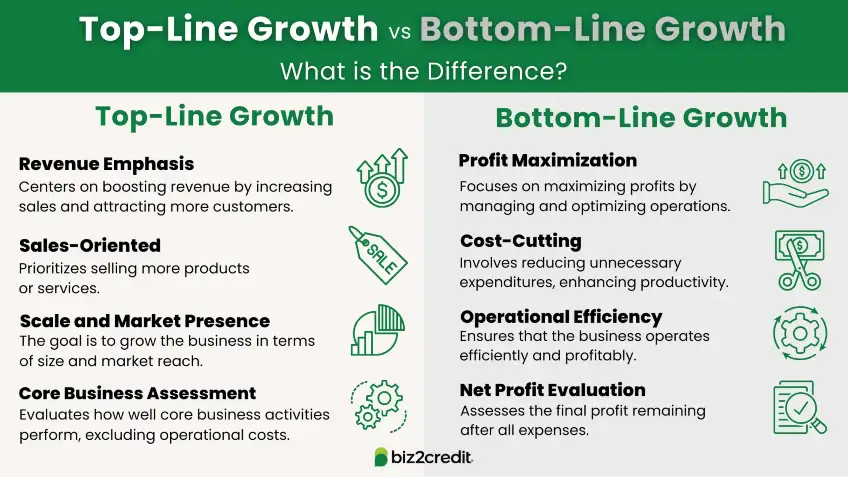

A company’s financial health is often assessed by examining its top line and bottom line:

- Top Line (Revenue): This refers to the company’s total sales or revenue. Consistent growth in revenue over a period of three to five years indicates a healthy demand for the company’s products or services.

- Bottom Line (Net Income): This is the company’s profit after all expenses have been deducted from revenue. Steady growth in net income suggests effective cost management and profitability.

Reviewing a company’s income statements over several years can provide insights into its financial trajectory.

🏭 Understanding Industry Types: Defensive vs. Cyclical

Industries can generally be categorized into two types:(moneymorning.com)

- Defensive Industries: These sectors, such as utilities and healthcare, provide essential goods and services that remain in demand regardless of economic conditions. Companies in these industries often offer stability and consistent dividends.

- Cyclical Industries: These sectors, including automotive and luxury goods, are sensitive to economic cycles. Their performance tends to improve during economic expansions and decline during recessions.

Understanding the nature of the industry helps in assessing potential risks and returns associated with investing in specific sectors.

🧠 Setting Realistic Expectations

It’s crucial to approach investing with realistic expectations. Rather than seeking perfection, focus on identifying companies with consistent growth trends and sound business models. Patience and a long-term perspective are key to successful investing.

✅ Beginner’s Checklist for Picking Stocks

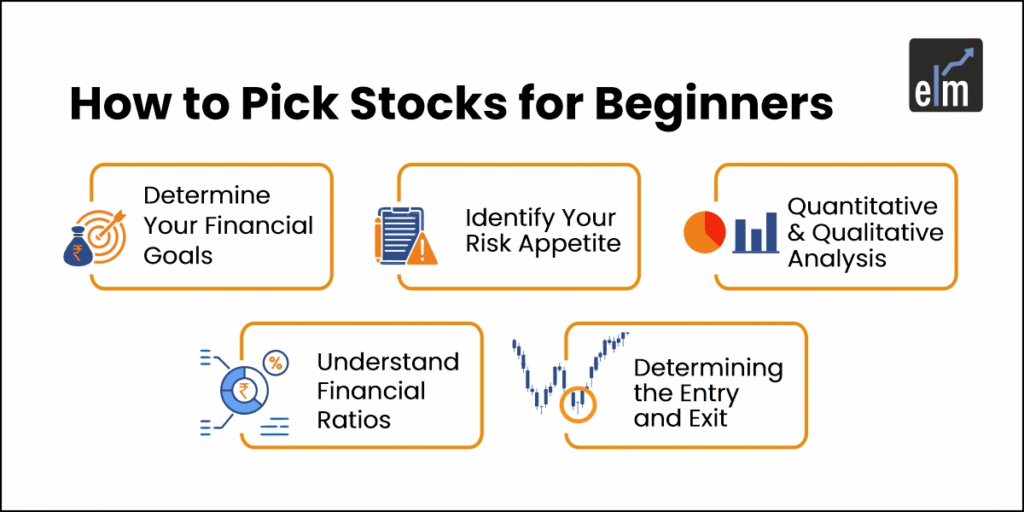

To assist in your investment journey, consider the following checklist:

- Define Your Investment Goals: Are you seeking growth, income, or capital preservation?

- Assess Financial Statements: Look for consistent revenue and profit growth over the past 3–5 years.

- Understand the Industry: Determine whether the company operates in a defensive or cyclical industry and how that aligns with your risk tolerance.

- Evaluate Company Fundamentals: Examine metrics such as debt levels, profit margins, and return on equity.

- Research Management and Competitive Positioning: Strong leadership and a competitive edge can contribute to a company’s long-term success.

- Diversify Your Portfolio: Spread investments across various sectors to mitigate risk.(theguardian.com)

- Stay Informed: Keep up with market trends and news that may impact your investments.

Embarking on your investing journey requires diligence and continuous learning. By focusing on consistent growth, understanding industry dynamics, and setting realistic expectations, you can build a solid foundation for making informed investment decisions.